Nothing on this website is not an offer to sell a security, any offer must be accompanied by PathFree Expansion LLC’s Private Placement Memorandum

Accredited Investors

Welcome, accredited investors, to an exceptional opportunity to invest in PathFree Expansion LLC, and for you to participate in a cutting-edge medical device company that has developed multiple patented devices set to change the landscape of the healthcare industry.

At PathFree Technologies Corporation, we are seeking investment to expand our manufacturing and distribution capabilities, aiming to bring our innovative devices to the global market. As a Reg D 506c Security offering convertible common units, PathFree Expansion LLC is offering a unique opportunity for investors to share in the company’s profits for a period of 5 years.

Investing in PathFree Expansion LLC is a smart choice for investors who want to be a part of a medical device company that is at the forefront of medical innovation. PathFree Technologies Corporation has developed patented devices that provide healthcare professionals with cutting-edge technology to improve patient outcomes. The devices are designed to address unmet medical needs and offer a safer and more efficient alternative to existing devices.

As an investor in PathFree Expansion LLC, you will be entitled to 50% of PathFree Technologies Corporation’s profit annually, paid out on a quarterly basis, for 5 years. With very conservative projections, you can expect to receive a return of 57% annually on the low end. Furthermore, you will also have the choice of return of capital or to convert your units into shares of equity in PathFree Technologies Corporation on a 1 for 1 basis. This provides a further opportunity for investors to profit from the growth and success of the company in the long term.

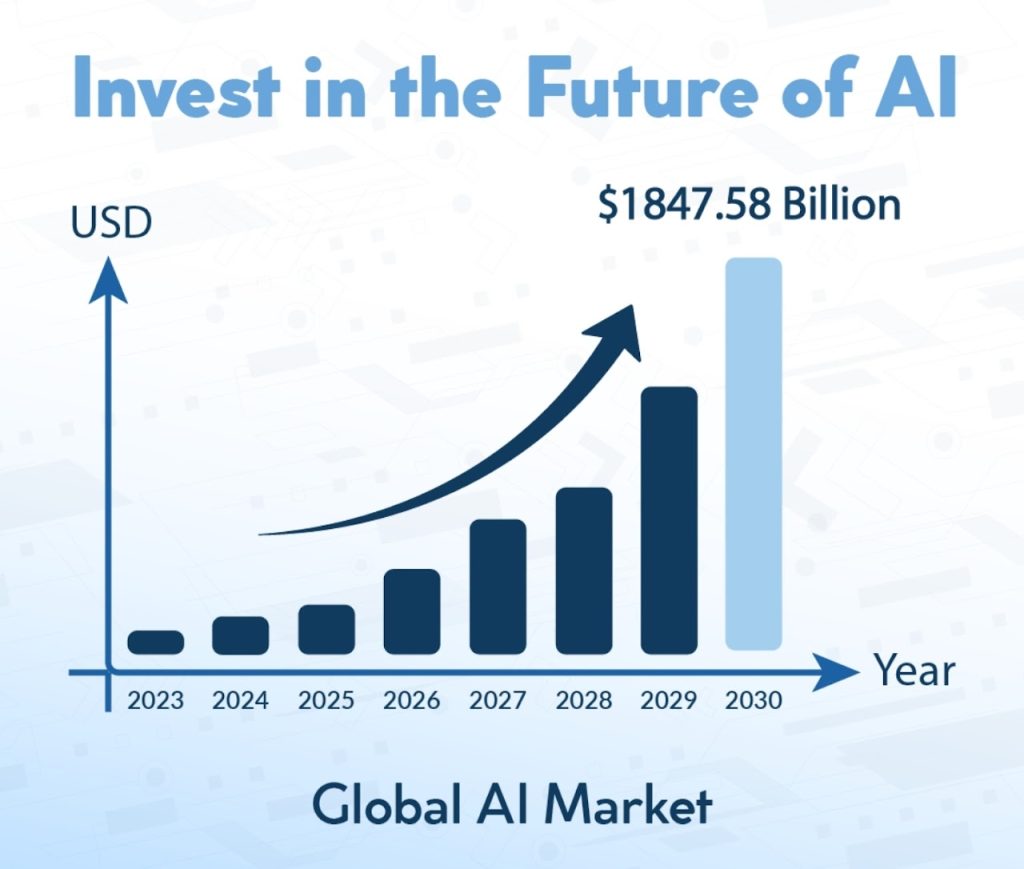

PathFree Technologies Corporation has a significant growth potential, with the global medical device market set to reach $612 billion by 2025. The devices are on schedule to receive FDA clearance, paving the way for their commercialization in the United States and the rest of the global medical community. This offers investors a unique opportunity to profit from a cutting-edge medical device company with significant growth potential.

Our management team at PathFree Technologies Corporation consists of experienced industry professionals who have a deep understanding of the market and a proven track record of success. This provides investors with confidence in the company’s ability to execute its growth plans.

Investing in PathFree Expansion LLC is an opportunity that investors should not miss. Our devices are designed to revolutionize the healthcare industry and offer investors a rare opportunity to be a part of a company that is changing the world for the better.

The medical devices developed by PathFree Technologies Corporation have already generated a lot of interest in the industry. We have a strong patent portfolio that gives us a competitive edge and significant market potential. Our devices are designed to be more efficient, less invasive, and safer than existing devices.

PathFree Technologies Corporation is committed to ensuring that our devices are accessible to healthcare professionals globally. With the investment we receive from PathFree Expansion LLC, we plan to expand our manufacturing and distribution capabilities to bring these innovative devices to the global market.

We believe that our devices have the potential to change the healthcare industry for the better, and we are committed to making this a reality. By investing in PathFree Expansion LLC, investors will be a part of a company that is making a positive impact on the world.

In conclusion, we thank you for considering PathFree Expansion LLC as your investment choice. Our devices have the potential to revolutionize the healthcare industry, and we believe that this investment opportunity is one that investors should not miss. With the potential to earn significant profit-sharing returns and the option to convert units into equity in PathFree Technologies Corporation, this is an opportunity that investors should seriously consider.

Why PathFree?

Investing in the stock market has long been considered a popular choice for those seeking to grow their wealth. However, with the volatility and unpredictability of the stock market, many investors are turning to alternative investment options that offer a more stable and consistent return. One such option is the Reg D 506(c) Convertible Common Units offered by PathFree Expansion LLC.

What is PathFree Expansion LLC?

PathFree Expansion LLC is a private investment company that offers a unique investment opportunity for those looking to diversify their portfolio. The company’s Reg D 506(c) Convertible Common Units offer investors a fixed and consistent return on investment, with the potential for long-term growth and returns.

Fixed and Consistent Return on Investment

One of the primary benefits of investing in PathFree Expansion LLC’s Reg D 506(c) Convertible Common Units is the fixed and consistent return on investment. With the units entitling the holder to 50% of the company’s profits annually for a period of 5 years, investors can expect a reliable source of income with the potential for a high rate of return.

In contrast to the stock market, which can be highly volatile and unpredictable, PathFree Expansion LLC offers investors a more stable and predictable investment opportunity.

Option to Convert Units into Equity

Another significant advantage of investing in PathFree Expansion LLC’s Reg D 506(c) Convertible Common Units is the option to convert units into shares of equity in PathFree Technologies Corporation. This means that investors have the potential to benefit from the long-term growth and success of the company, as well as potential gains in the value of their investment.

Investors who choose to convert their units into equity will have the opportunity to participate in the company’s decision-making process and may receive dividends if the company chooses to distribute them.

Stability and Security

Investing in PathFree Expansion LLC can offer more stability and security than investing in the stock market. Private companies like PathFree Expansion LLC are typically less exposed to market volatility and have a longer-term outlook, which can provide a more stable and sustainable investment opportunity.

Moreover, investors can be confident that their investment is in capable hands, with a management team that has a deep understanding of the market.

Conclusion

In conclusion, investing in PathFree Expansion LLC’s Reg D 506(c) Convertible Common Units offers several advantages over investing in the stock market. With a reliable source of income, the potential for long-term growth, and greater stability and security, investors can benefit from a more predictable and profitable investment option.

Investors looking for a secure and stable investment opportunity should consider investing in PathFree Expansion LLC’s Reg D 506(c) Convertible Common Units. With a fixed and consistent return on investment and the option to convert units into equity, investors can benefit from both short-term and long-term gains. Moreover, the company’s stable outlook make it an attractive investment option for those seeking to diversify their portfolio.

Acquisitions of medical device manufacturers

Medtronic plc: This Irish medical device company has been publicly traded since 1957 and is one of the largest medical device companies in the world. Medtronic has made several high-profile acquisitions over the years, including Covidien in 2015 and Mazor Robotics in 2018.

Stryker Corporation: Stryker is a US-based medical device company that has been publicly traded since 1979. The company has a strong focus on orthopedic devices, and has made several acquisitions in this space, including Mako Surgical Corp. in 2013 and Wright Medical Group in 2020.

Boston Scientific Corporation: Boston Scientific is a US-based medical device company that has been publicly traded since 1992. The company focuses on a wide range of medical specialties, including cardiology, urology, and endoscopy. Boston Scientific has made several notable acquisitions over the years, including Guidant Corporation in 2006 and BTG plc in 2019.

Abbott Laboratories: Abbott is a US-based healthcare company that has been publicly traded since 1929. The company has a strong presence in the medical device industry, particularly in the areas of cardiovascular and diabetes care. Abbott has made several acquisitions over the years, including St. Jude Medical in 2017 and Alere Inc. in 2018.

Zimmer Biomet Holdings, Inc.: Zimmer Biomet is a US-based medical device company that has been publicly traded since 2001. The company specializes in orthopedic devices, and has made several notable acquisitions in this space, including LDR Holding Corporation in 2016 and Biomet, Inc. in 2015.

Please note that this list is not exhaustive and there are many other medical device manufacturers that have gone public or been acquired. It’s important to do your own research and due diligence when making investment decisions.

Nothing on this website is not an offer to sell a security, any offer must be accompanied by PathFree Expansion LLC’s Private Placement Memorandum

Types of Investors

As an individual investor, there are different ways to invest in early-stage businesses and startups. Angel investors, venture capital firms, and private equity firms are all sources of funding that offer different benefits and risks. Here we aim to provide an overview of these funding sources and their respective advantages and disadvantages.

Angel investors typically make relatively small investments in early-stage businesses and startups. They usually do not take a controlling stake in the company and let the business grow on its own. These businesses may not have a proven profit model or any revenue at all yet. Angel investors expect a higher return on their investment than they would receive from traditional investments in stocks and bonds. In general, they get a percentage of equity in the company, a percentage of future profits, or a combination of both, which can potentially earn larger returns.

Venture capital firms invest in young businesses and startups, but a little later in the life cycle than angel investors do. Venture capital investment typically favors businesses that lack the resources to scale up a proven profit model. Private equity firms focus on mature businesses that are already generating a profit. It is common for private equity firms to buy a controlling stake in the business, but minority positions are also common in certain cases.

When comparing angel investing, venture capital, and private equity, there are several key differences. Factors that affect the choice of funding source for a business include the stage of the business, the amount of investment needed, and the expected returns. Each funding source has its own advantages and disadvantages, and it is important for businesses to understand these differences before deciding which funding source to pursue.

In terms of investment amount, angel investors typically invest smaller amounts compared to venture capital and private equity firms. Angel investors usually invest between $100,000 to $200,000 per company, while venture capital firms can invest up to several million dollars, and private equity firms can invest even larger amounts.

Angel investors and venture capital firms both invest in early-stage businesses and startups, but the difference lies in the investment stage. Angel investors invest in the earliest stages of a company’s life cycle, while venture capital firms invest in businesses that are beyond the startup phase but still lack the resources to scale up a proven profit model.

On the other hand, private equity firms focus on mature businesses that are already generating a profit. Private equity firms usually buy a controlling stake in the business, which allows them to have more control over the company’s operations.

Expected returns also differ between the three funding sources. Angel investors expect higher returns than traditional investments in stocks and bonds, typically in the range of 20-30%. Venture capital firms expect returns of around 30-40%, while private equity firms expect returns of 20-30%.

In conclusion, understanding the differences between angel investing, venture capital, and private equity is crucial for businesses seeking funding. Each funding source has its own advantages and disadvantages, and businesses should carefully consider their options before making a decision. By doing so, they can find the right funding source that suits their needs and goals.

IRA Investors

Private Placement – Private Equity

Sophisticated investors flock to private equity investments in IRAs.

Private equity is a unique investment that can fit well in a self directed IRA. It is important to note that these types of closed investments are usually only open to Accredited Investors. Private equity can invest in a wide array of options including, closed business stock, venture capital, or a pooled investment vehicle like an LLC, LP, or hedge fund. Inside each company, they may be investing in real estate, private lending, or purchasing companies. Because of each deal’s complexity, it is essential to discuss these investments’ pros and cons with your financial or tax advisor.

Investing in private equity with a self directed retirement plan:

A self directed retirement plan can invest in most private offerings. These offerings include private equity/private stock. When investing in private equity with a retirement account, the dividends and gains from investments are paid directly to the retirement account. These dividends are either tax-deferred (Traditional IRAs) or tax-free (Roth IRAs). There can be capital calls with these types of investments, so please understand the investment and how it affects your IRA.

Investing in private equity within an IRA has been an option since 1974. However, the vast majority of investors are not aware of this option. This unawareness is due to traditional retirement account custodians limiting investments to Wall Street stocks, bonds, and mutual funds. Our custodian allows investors to choose alternative assets such as real estate and private equity investments to build their wealth.

Who can invest in private equity with a self directed IRA?

Typically, these alternative assets are limited to accredited and institutional investors. Accredited investors are those proven to be financially fit to invest large amounts of funds over a long time without sustaining a substantial hardship if the asset is fruitless. These funds may include investing in startup businesses, developing technology, gaining capital to improve an existing entity’s viability, and even acquiring an existing business.

Accredited investors can use their self directed IRAs and other retirement plans to invest in a private stock. This strategy allows investors to build tax-sheltered income in their accounts. Our custodian works closely with clients investing in private equity to facilitate the purchase in compliance with current rules and regulations. Their ability to do this maintains the account’s tax-advantaged status. It enables clients the precious time to identify holdings they believe will increase their potential for building retirement wealth.

Learn about the SEC’s new accredited investor status.

To take advantage of PathFree Expansion LLC Convertable Common Units using funds from your IRA, call our IRA specialist at PathFree Technologies at (949)257-2688 for more information about our exclusive IRA custodian Midland Trust today!

Coming Soon!!!

PathFree Technologies Corporation’s Equity Offering

Scan the QR code for a copy of the Business Plan: